Slide is a free app that allows you to earn 2-10% cash back at more than 300 retailers and restaurants both online and in stores.

I downloaded the app to check out Slide myself, and I compared it to other popular cash back apps to see if it’s worth using.

In this article, I’ll take a close look at five things to know about Slide before you download the app and get started.

This article was updated in July 2023 and I review it every 12 months. Detailed notes on all updates can be found here.

5 Things To Know Before Earning Cash Back With Slide

Whether you typically shop online or in-store, there are many ways to make sure you’re always getting the best deal. Beyond comparing prices and shopping the sales, promo codes, coupons and cash back apps are great ways to maximize your savings.

If you’ve been looking into ways to earn cash back, you may have come across Slide. Slide is a cash back app that’s available on the App Store and Google Play. Once you download the app, you can link a payment method and shop at eligible retailers online or in-store using Slide as your payment method.

With each purchase you make using Slide, you’ll earn 2-10% cash back. Once you earn $15, you can withdraw your earnings. However, it’s important to protect yourself when entering personal banking information on a third-party app such as this. If you still plan on downloading Slide after this review, be sure to read my tips on how to maximize your earnings and keep yourself safe.

If you’re thinking about downloading Slide to earn cash back, here are five things to know.

Table of Contents:

- What Is Slide?

- How Does Slide Work?

- How Does Slide Compare?

- How To Get the Most Out of Slide

- Final Thoughts: Pros and Cons

Below, you’ll find more detailed information on Slide including what to expect once you’ve created an account and how to start earning cash back.

1. What Is Slide?

Made by the same company that created Raise, Slide is a legitimate cash back app that allows you to earn 2-10% cash back on in-store and online purchases through select retailers.

Slide works at more than 300 retailers and restaurants across several categories: apparel, automotive, dining & delivery, entertainment, groceries, travel and more.

However, unlike other cash back apps, Slide doesn’t work by uploading receipts after you make your purchase. Instead, you’ll link a payment method to the Slide app and pay directly with Slide. When you make a purchase with Slide, you’ll instantly earn cash back. Once you earn a total of $15, you can withdraw your earnings through Venmo or PayPal.

When I tried out the Slide app myself in July 2023, the app had a 4.4-star rating on the App Store from 2.5K reviews. On Google Play, Slide had a 3.3-star rating based on 2.06K reviews.

Based on these ratings and my own experience, I feel it’s safe to say that Slide is a legitimate cash back app. However, whether or not it’s worth your time depends on where you shop most frequently.

2. How Does Slide Work?

Slide works more like a prepaid gift card than your typical cash back app. Instead of uploading a receipt after your purchase, you’ll enter the total purchase amount ahead of time, and Slide will create a digital gift card that you can use online or in-store to make your purchase.

Slide creates the digital gift card for you based on the amount you enter and then charges that amount to your selected payment method: Apple Pay, PayPal, BitPay, debit card or credit card.

Of course, this is a little more invasive than other cash back apps. Here’s what Slide’s website says regarding information security:

“We maintain appropriate administrative, technical, and physical safeguards designed to help protect personal information collected or received through the Services. Although we use reasonable efforts to safeguard information, transmission via the Internet is not completely secure and we cannot guarantee the security of your information collected through the Services.”

You can read Slide’s full privacy policy here.

How To Earn Cash Back With Slide

To get a better understanding of how the Slide app works, I downloaded it myself and made an online purchase. Creating an account and adding a payment method was easy. I chose to add PayPal and simply logged in through the PayPal app on my phone to verify my account.

Once you’ve added a payment method, you can either transfer funds to your account in advance or you can wait until you’re ready to make a purchase so that you can transfer the exact total. Adding funds to your account in advance is a way to earn an additional 1%-2% cash back. Of course, I did this to try to maximize my earnings.

Screenshot: Slide

Uploading funds ahead of time is optional.

Whether you do that or not, when you’re ready to make a purchase, here are the steps to pay with Slide:

- Choose an eligible retailer or restaurant.

- Enter your total purchase amount.

- Use the barcode or card numbers to pay in-store or online.

- Withdraw cash back or apply it toward your next purchase.

I chose to place an order at PetSmart. I clicked on PetSmart in the Slide app and then clicked “Shop online.” An in-app browser popped up, and I was able to browse items and add things to my cart as normal from the PetSmart website.

When I was ready to check out, I entered all of my shipping information and then clicked “Pay with Slide.”

I entered the exact total of my order, saw the amount I’d earn in cash back, and clicked “Review.”

When I slid to complete my payment, it took just a minute for Slide to confirm my transaction, and the “Pay with Slide” button changed to say “View Card Details.” There, I saw a card number and PIN to enter into the gift card section of the checkout screen and complete my payment.

After I placed my order, I received a confirmation email from both Petsmart and Slide. The cash back I’d earned was immediately visible in my Slide account, though you can’t withdraw your cash back balance until you’ve reached $15. Once you do, you can transfer it to your Venmo or PayPal account or leave it in your Slide account to put toward future purchases.

3. How Does Slide Compare?

I’ve tested several cash back and money-saving apps over the past few years including Checkout 51, Ibotta, Rakuten and more.

To see how Slide compares to the rest, I took a closer look at each cash-back app’s average cash-back range, minimum payout, payout options, process and availability.

Here’s what I found.

| Average Cash Back Range | Minimum Payout | Payout Options | How It Works | Availability | |

|---|---|---|---|---|---|

| Checkout 51 | 1%-6% per purchase | $20 | Check PayPal Electronic gift cards | Activate offers and upload receipts. Shop directly through the app and pay as normal at checkout. | Thousands of brands; gas, groceries and more |

| Fetch Rewards | Points instead (around 25 points per receipt) | 3,000 points ($3) | Electronic gift cards | Upload receipts. Select brands earn more points. | Any store; featured brands focus on groceries and household essentials. |

| Ibotta | $0.25-$2 per item | $20 | Direct deposit PayPal Electronic gift cards | Activate offers and upload receipts. | More than 300 retail chains, restaurants and more; mainly groceries |

| Rakuten | 1%-6% per purchase | $5 (quarterly payouts) | Check PayPal | Activate offers and shop online through the app. Link your credit or debit card for in-store purchases. | More than 3,500 stores including groceries, travel, dining and more |

| Slide | 2-10% per purchase | $15 | PayPal Venmo | Link your payment method to pay with Slide directly. | More than 300 stores including restaurants, retail and more |

| ReceiptPal | Points instead (around 25 points per receipt) | 2,200 points ($5) | Electronic gift cards | Upload paper receipts. Link accounts to earn on digital receipts. | Any U.S. store |

Compared to other apps, Slide offers an average amount of cash back, but it is consistently 4% whereas other apps are likely to have more 1% offers on popular items.

Unfortunately, Slide is available only at a limited number of retailers and an even more limited number of grocery stores. When I tried out Slide in July 2023, the only “grocery stores” that were partnering with Slide were Instacart, Total Wine and More and The Vitamin Shoppe. So if you’re looking for cash back purchases on groceries, Slide is certainly not the best option.

Slide also offers an average minimum payout (less than Ibotta and Checkout 51, but more than Fetch Rewards or Rakuten) and two instant payout options.

When using the app, I found that I didn’t like having to link my payment options directly with Slide. However, I did like the simplicity of not having to claim offers or upload receipts after purchase. Shopping with Slide was as seamless as shopping with a digital gift card, and I instantly saw the cash back in my account.

4. How To Get the Most Out of Slide

If you’re thinking about signing up for Slide, there are a few things you can do to maximize your earnings and get the most overall out of the cash back app.

After trying out Slide myself, here are my tips for both maximizing your earnings and keeping yourself protected through the third-party payment app:

- Use your cash back credit card. Choose a secure payment method to link to Slide such as a credit card. If you link a credit card that already earns cash back on purchases, you’ll just earn 4% more by paying with Slide! This is a great way to maximize your cash back.

- Take advantage of promotional credit. When you first sign up for Slide, you’ll get $5 off your first four purchases ($20 in promotional credit). While you can’t withdraw this promotional money, you can use it to shop online or in stores and earn cash back that you can withdraw. Additional ways to earn promotional credit include inviting friends to use Slide (up to an additional $20 in Slide credit per friend).

- Preload money to your Slide account — but only what you need! You can get an additional 1%-2% back by loading your Slide account before it’s actually time to make a purchase. This is a great way to maximize your earnings, but be aware that Slide works like any other digital gift card: Once you load your money onto the card, you cannot (easily) withdraw it again. You can contact Slide for a refund of the money you’ve added to your Slide account, but there is no easy way to withdraw the funds you’ve already added.

- Plan ahead on purchases. While you can earn more cash back by preloading your Slide account, I don’t recommend adding a bunch of money and letting it sit there until an eligible purchase pops up. Instead, plan your purchase ahead of time and know what your exact total will be online or in-store. Then you can add the exact funds needed to your Slide account ahead of time. You can even do this moments before you make the purchase to take advantage of that additional 1%-2% cash back.

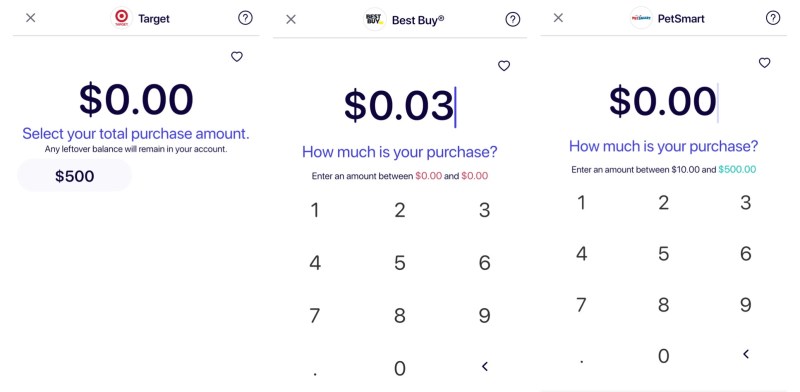

- Determine “eligible” retailers before you’re actually ready to pay. Not all retailers will allow you to enter a custom amount for payment, so be sure to check this in the Slide app before you actually check out. When I tried Slide, I found that one store only allowed me to use a $500 gift card. I also found another retailer that was listed as a store on the Slide app, but I couldn’t actually use it: When I tried to enter an amount to pay, the screen said the eligible amounts were “$0.00-$0.00.”

I had originally planned on placing an order from Target (no longer partnered with Slide) but was not prepared to load $500 to my Slide account. When I contacted Slide to find out what was going on, I received this response:

“Different brands have different restrictions around the dollar amount you are able to purchase on Slide. Some brands allow you to choose an exact dollar amount while others have specific denominations. We have no control in this matter as this is determined by the brand.”

For this reason, I recommend checking “eligible” retailers before preparing to make your purchase.

5. Final Thoughts: Pros and Cons

Slide is a legitimate cash back app that offers 4% back for eligible online and in-store purchases. When I tested it out myself, I found that it was really convenient to use compared to other cash back apps but also required more personal information and didn’t work at many stores.

Before you download Slide yourself, here are the major pros and cons to keep in mind.

Pros:

- Speedy customer service via email. Slide’s customer service is available Monday through Sunday from 10a.m. to 6p.m. EST and can be reached by emailing [email protected]. When I reached out to Slide customer service, I received fast, knowledgeable responses via email during business hours.

- 2-10% cash back on every purchase. Unlike other cash back apps, all eligible Slide purchases offer 2-10% cash back.

- You don’t have to claim offers or upload receipts after the purchase. Instead, you’ll make purchases directly with Slide either online or in-store.

- Cash back is instantly available in the app for future purchases. Once you make an eligible purchase through Slide, your cash back is immediately available in the app and you can use it on future Slide purchases even before you reach $15.

Cons:

- You have to link a payment method directly to Slide. Unlike other cash back apps, you do have to provide more personal banking data with Slide, and it can never be guaranteed to be completely safe.

- No phone number for customer service. You are able to contact Slide only by email.

- Limited number of eligible stores. Compared to other cash back apps, Slide doesn’t offer cash back at many retailers and a limited number of grocery stores in particular.

- Not all stores on the app are eligible for cash back. I saw some retailers listed in the app that weren’t actually eligible. Additionally, some retailers won’t allow you to enter the amount needed to make your desired purchase.

- You can’t withdraw money you’ve added to your Slide account. Once you add money to your Slide account, it becomes a prepaid gift card that you can’t easily transfer back to your bank account without contacting Slide customer service.

I will likely continue to use Slide until I reach my $15 cashout minimum and then let it go. I prefer to keep the number of third-party apps linked to my bank account to a minimum, and I don’t feel that I shop often enough at Slide-eligible stores often to justify keeping it. However, I recommend checking out the full list of Slide stores to see if Slide would be worth your time.

Fortunately, Slide is far from the only cash back app available. Be sure to check out Ibotta, Checkout 51, Fetch Rewards and Rakuten for more opportunities to save.

Have you used the Slide app? Let us know your experience in our Clark.com Community!

Article Updates

- July 31, 2023: Updated partnered retailers, average cash back percentages and app reviews

- July 31, 2023: Removed Google Pay as a payment method

- July 31, 2023: Removed “Slide Selects” and noted that Target is no longer partnered with Slide (seen in the example above)