Do you need to make a payment on Venmo but are uncomfortable tying the app to your bank account?

You have some alternatives. You can use a credit card to make a payment on the Venmo app, but there are some fees involved that could make it an issue for you, depending on which merchant you’re paying.

In this article, I’ll look at the policies for using a credit card on Venmo and the situations in which it makes the most sense as a payment method.

Table of Contents

- 6 Things To Know About Using a Credit Card on Venmo

- How To Set Up Your Credit Card on Venmo

- Should You Use a Credit Card on Venmo?

- Why Clark Howard Doesn’t Love Payment Apps

- Best Credit Cards To Use on Venmo

6 Things To Know About Using a Credit Card on Venmo

If you’re considering putting your credit card on file with Venmo, there are some things you should know before you start using it for transactions.

There Is a Fee for Using Credit Cards for Personal Transactions

Venmo charges a 3% fee for sending money with a credit card. This applies to funds you may send to your family and friends, and it could add up pretty quickly.

For example, a $50 payment sent to your sibling to split the cost of a birthday gift would cost you an additional $1.50 if you used a credit card to send the money via Venmo.

This charge does not apply to debit card transactions.

Beware: Some Credit Cards May Record Personal Transactions as Cash Advances

If you choose to accept that 3% fee from Venmo to send money to friends or family (we don’t recommend it), you may also encounter additional fees from your card issuer.

According to Venmo, “Some credit card providers charge cash advance fees (possibly including an additional dollar amount or percent rate, in addition to other possible cash advance service fees, including a higher APR) if you use your credit card to make payments to friends on Venmo.”

We cannot stress enough what a bad idea this is!

Let’s use the Citi Double Cash, which is one of Clark Howard’s recommended credit cards, as an example of how using it with Venmo could go downhill quickly.

Double Cash charges $10 or 5% of the total transaction (whichever is greater) for processing a cash advance transaction. From there, a cash advance balance is subject to an APR of more than 25% moving forward.

If you’re planning to use a credit card for a personal transaction on Venmo, please take the extra step to contact your card provider to see if it’s going to treat the transaction as a cash advance.

And if the answer is “yes,” please consider an alternative way to fund your Venmo account.

Purchases Through Merchants Won’t Carry a Fee

If you’re making a purchase with a credit card via Venmo through a merchant’s website on in store, you will not be subject to the 3% fee mentioned above.

Instead, the business from which you’re making that purchase will be responsible for covering the credit card fees for the transaction, similar to the experience you have at a brick-and-mortar retail store.

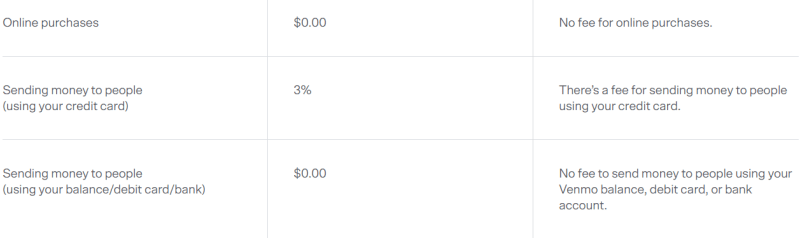

To better understand when you will be subjected to the 3% fee for using your credit card and when you won’t, here’s a handy chart from Venmo on the topic.

Small Businesses May Be Your “Tricky” Spot for Using Credit Cards

The line in the sand is pretty clear for most transactions:

Sending money to friends? A credit card fee will apply. Paying for purchases online? A credit card fee won’t apply.

But there is some grey area you may want to consider when deciding whether to use a credit card as your payment method on Venmo.

If you pay an individual who has a business account with a credit card, they may also be subject to fees. Think of the owners of very small businesses in your life, such as the person who mows your lawn or walks your dogs while you’re away.

These people may have a business account set up with Venmo to allow you to pay them with a credit card, but in doing so you’ll actually be taking some of that money back of their pockets, as they’ll have to foot the bill for the credit card fees.

You may have no issue with this when paying a big business like Walmart or Amazon, but you may want to think twice about it when paying someone who you may consider a friend.

You Can Earn Credit Card Rewards on Purchases Made With Venmo

You can earn credit card rewards by paying through Venmo, but specific reward categories may not translate because of the way the purchases are reported to your card issuer.

Typically, you will receive rewards in certain categories based on the transaction code that the merchant reports to your card issuer. So, for example, if you use a card that earns gas rewards at a gas station, you’ll get your proper rewards for that transaction based on the coding that indicates your were buying from a gas merchant.

This should still be the case if Venmo is a go-between, but it’s not guaranteed. Keep that in mind when calculating your expected rewards.

Of course, if you’re using a flat-rate cash back card, the type of transaction may not matter.

You Can’t Transfer Funds from Your Venmo Account to Your Credit Card

Though you can use a credit card to fund your Venmo transaction, you cannot use a Venmo balance to apply toward your credit card balance.

You must either spend your Venmo balance with merchants or withdraw through a handful of methods, which most notably include transferring to an attached bank account or debit card.

Once the money’s back in your bank account, you could then use those funds to pay your credit card balance.

How To Set Up Your Credit Card on Venmo

You can add a credit card to your account via either a computer or the app. Venmo provides the following instructions for each method.

Setup on a Computer

To add a card to your Venmo account from a computer, click here and click “Edit payment methods” and then “Add Debit or Credit Card” then add your card information.

Setup on the App

If you’re on the Venmo app, please follow the instructions below:

- Go to the “You” tab by selecting the person icon on the home screen

- Tap the Settings gear in the top right then tap “Payment Methods”

- Tap “Add bank or card…” and then tap “Card”

- Add your card information manually or with your phone’s camera

Should You Use a Credit Card on Venmo?

Now that you know you can use one and we’ve told you how to do it, the most important question may still be lingering: Should you?

The answer is maybe.

If you’re paying a merchant, using a credit card to make a payment on its website or in-store (where available) is perfectly fine. You won’t be subject to fees, and you won’t have to share your credit card information with that merchant.

If you’re paying friends or family, the 3% fee you’ll encounter is probably a dealbreaker. Not only will you be costing yourself more money on the transaction, but you may also be triggering a cash advance transaction with your card issuer that could cost you even more money.

Alternatives to Using a Credit Card

As I mentioned earlier in the article, there is no fee associated with debit card transactions on Venmo.

But money expert Clark Howard generally dissuades consumers from using a debit card to pay for anything. And he also advises against attaching your primary savings or checking account to a payment app.

His proposed solution, which may be your best credit card alternative, is to open a secondary checking account that contains a limited amount of funds for the purposes of online transactions such as these.

Why Clark Howard Doesn’t Love Payment Apps

If you’re a loyal listener to The Clark Howard Podcast, it likely comes as no surprise to you that money expert Clark Howard is not the biggest fan of payment apps such as Venmo, Cash App and Zelle.

This isn’t because Clark is opposed to the conveniences afforded to use by the advancements of financial technology.

It’s because he consistently hears from readers and listeners who are losing hard-earned money on these apps by way of tricky scams, misunderstood fees and unforgiving bank policies.

“If a criminal is able to tap into your account, the money is likely gone forever,” Clark said on a recent podcast while lamenting the policies of Venmo competitor Zelle, “because the banks have been able to stop any regulatory action or laws being passed that would give consumers normal protection.”

Clark says once you have money showing as a balance on one of these payment apps, the protections that money would receive in a bank account are gone.

“Let me tell you what the deal is,” Clark said. “If a fraudster hits up your bank account or credit union account, even if you got fooled by them, the bank has to restore your funds. That’s just the law. Same thing if there’s a hack. The funds must be restored.”

He says that banks and credit unions don’t hold that same obligation once the money is outside their control on these payment apps, even if your bank account information is connected to said app.

As mentioned earlier, Clark’s solution to this mess is using a secondary bank account with limited funds to connect to these payment apps (only when necessary) and then removing balances from those payment apps as soon as possible.

Best Credit Cards To Use on Venmo

If you’ve decided to put a credit card on your Venmo account, you may be wondering which card in your wallet is the best fit.

Some things to consider as you pick the right card include:

- Which card offers the best rewards for generic purchases? The spending category in which your credit card purchases with Venmo fall probably will vary. And there’s a chance that they aren’t even accurately assigned due to the extra layer of purchase protection Venmo provides, so it may be best to pick a card that gives you a flat rate of rewards no matter what type of purchase you make. Team Clark recommends a flat 2% cash back card.

- Does your credit card issuer consider a personal payment a cash advance? I discussed this earlier in the article, but you should definitely avoid using a credit card that will ding you for a cash advance if your transaction is considered a personal money transaction between family and friends. That could have potentially disastrous fees associated with it.

If you find yourself becoming a regular user, you might want to consider applying for the Venmo Credit Card. It automatically gives you 3% cash back on your top spending category each month, makes the rewards available to use as Venmo balance and has other perks that are integrated into the Venmo app.

More Clark.com Content You May Like:

How Many Credit Cards Should I Have? - Are you worried that the number of credit cards you have could have a negative impact on your financial life? Is there a “right” number of credit cards for one person to have in 2024? The answer is a little…

How Many Credit Cards Should I Have? - Are you worried that the number of credit cards you have could have a negative impact on your financial life? Is there a “right” number of credit cards for one person to have in 2024? The answer is a little…  Best Credit Card Sign-up Bonuses for 2024 - Team Clark spent hours reviewing the market for credit card sign-up bonuses and evaluated them according to the guidelines for usage set by money expert Clark Howard. Clark believes credit cards with exorbitant annual fees are a bad idea for most…

Best Credit Card Sign-up Bonuses for 2024 - Team Clark spent hours reviewing the market for credit card sign-up bonuses and evaluated them according to the guidelines for usage set by money expert Clark Howard. Clark believes credit cards with exorbitant annual fees are a bad idea for most…